If we talk about both global and domestic agencies, we are aware of the COVID-19 pandemic that it will be an economic tsunami for India.

It is also true that the country may not slip into a recession, that like the European Country, the US, or Asia-Pacific that have stronger trade ties to China, many economic analysts believe that the impact on India’s GDP growth will be significant.

Everyone knew that India is currently in the mid of the 21-day lockdown, that started on March 25, to lower down the spread of the coronavirus. If the move is not successful then it will spill over to the financial year 2021, which begins on April 1.

On March 26, finance minister Nirmala Sitharaman announced a 1.70 Lakh crore package aimed at lower the disruption. India’s central bank also joined the fight a day after with cutting the interest rate sharply and an easy flow of unconventional measures aimed at making credit available to beleaguered businesses.

India's GDP rate is already at a decadal low and any further epidemic in economic output will bring more pain to workers who want their wages to increase in recent times.

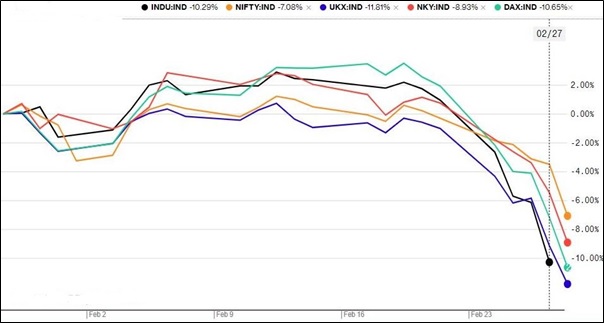

The impact of coronavirus on economic and market affect a lot on India’s financial markets as well as the rupee, which hit a new low economic structure and the US dollar in March due to global risk-off sentiment. Effective in the dollar-denominated debts, a continuous struggling of the rupee is likely to intensify their struggles to repay their Loans. But the COVID-10 occurs financial shocks, India has to urgently find a way to cushion the demand-side shocks induced by potential lockdowns and other ongoing containment measures.

You all aware of the seriousness of infections, after the self-imposed Janata curfew that occurs on March 22 across the country, 30 States and Union Territories have now announced a complete lockdown for the aim of flattening the pandemic curve. Such a long lockdown in the near future is likely to be cost the economic condition of India, with the pain falling disproportionately on those in the formal or informal sector.

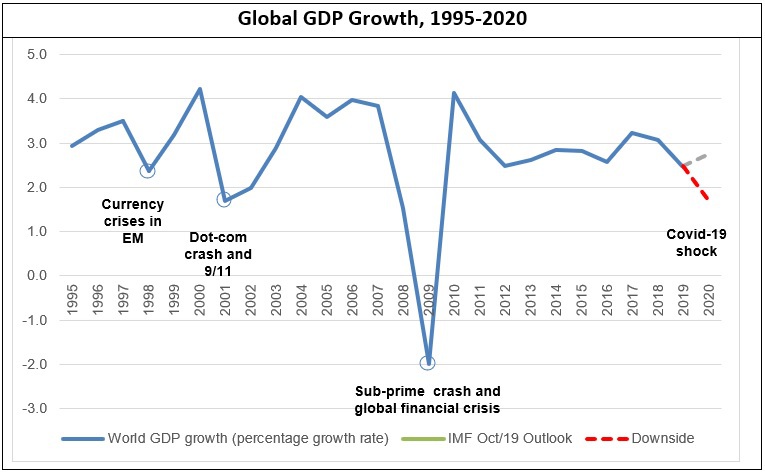

According to Fitch Ratings, India may cost an economic crisis with two-percent GDP growth in 2020-21, the slowest since the economy was liberalized 30 years ago.

The Asian Development Bank (ADB) communities by India's economic growth slipping to four percent in the current fiscal (April 2020 to March 2021), and Global Ratings last week further slashed its GDP growth forecast for the country to 3.5 percent from a previous exception of 5.2 percent.

Moody's Investors Service has also reduced its estimate of India's GDP growth during the 2020 calendar year to 2.5 percent from an earlier estimate of 5.3 percent and the estimated that coronavirus pandemic will cause an unprecedented shock to the global economy.

©Famous India Blog. All rights reserved.

Creativity By Needinfotech